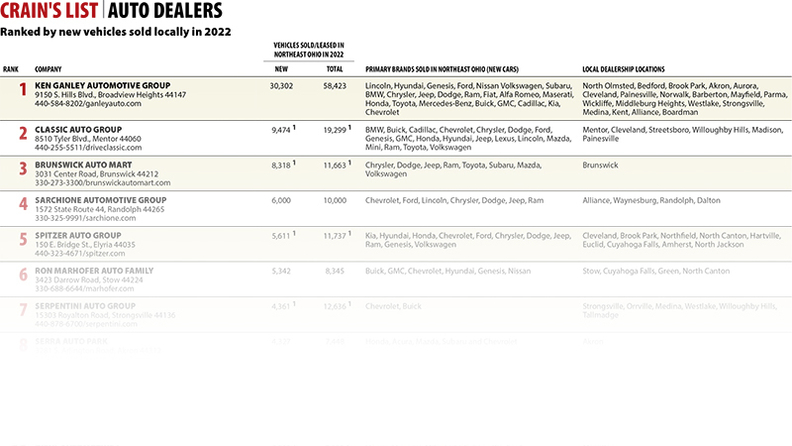

Perhaps we picked an unfair time to bring back our list ranking Northeast Ohio’s largest auto dealer groups.

2022 was the worst year for car sales in more than a decade. And that’s readily apparent when you compare this year’s list to the last one we published three years ago.

Combined, the auto groups on the list sold 16.4% fewer new vehicles from their Northeast Ohio dealerships in 2022 than they did in 2019, judging by data from the 32 groups on the list who also were included three years ago. The full Excel version of the list includes 41 auto groups.

And that’s saying something, especially given that this list is skewed toward larger auto groups, so it includes some who grew through acquisition.

Take Ken Ganley Automotive, which is in the top spot on the list by a long shot: Ganley sold 30,302 new vehicles locally in 2022. That’s up 1.6% from what Ganley reported to Crain’s for 2019.

But Ganley also has acquired several local dealerships during that time. For instance, in December 2022 the auto group acquired two Taylor Kia dealerships in the Youngstown area, and it bought Mentor Kia in February 2022.

Most auto groups on the list posted double-digit percentage declines in vehicles sold locally from 2019 to 2022. Among them were the next two companies on the list: Classic Auto Group and Brunswick Auto Mart. Data for those auto groups and others that didn’t submit information to Crain’s came from AutoView Online, which publishes state title registration data for Ohio dealerships.

Though we’re looking at data over a three-year period, for the most part a single year is to blame.

2022 was just a bad year to be an auto dealer. Sales throughout the region fell 16.5% last year, according to the Greater Cleveland Automobile Dealers’ Association. Nationally, automakers sold 13.9 million passenger vehicles in 2022, down 8% from 2021, according to research by Automotive News, a sister publication of Crain’s. It was the lowest year since 2011.

What happened? Microchip shortages jammed up the supply chain and made vehicles hard to get. That, along with broader inflation, caused prices to rise. J.D. Power reports that the average vehicle price rose 4.2% in 2022.

Though production is now ramping up, so are interest rates. An industry report from J.P. Morgan Research predicts that sales will rise, but only modestly, in 2023.

As for the list …

Despite that trend, a few auto groups on the list still saw local sales rise considerably. Of course one of them is Tesla, which saw new-vehicle sales rise by 11.9% between 2019 and 2022. It’s No. 21 on the list, up from No. 27 three years ago.

Serpentini Auto Group also jumped up the ranks, from No. 17 to No. 7. It helps that Serpentini acquired three Pat O’Brien Chevrolet dealerships in early 2020.

Speaking of acquisitions, there also are a few new names on the list this year. Last fall, Diehl Automotive Group of Butler, Pennsylvania, acquired the Waikem Auto Family, which owned several dealerships in Massillon. It’s No. 11 on the list.

Likewise, another Pittsburgh-area auto group, #1 Cochran, acquired Sweeney Auto Group of Boardman, putting it at No. 19.

If you didn’t recognize those new names, perhaps you’ll recognize this one: At No. 33 on the full Excel version of the list is Mark Wahlberg Chevrolet Auto Group in Avon. Of course, the name refers to actor Mark Wahlberg, who partnered with Jay Feldman to acquire Joe Firment Chevrolet in 2021.

All 41 auto groups are available in Excel format exclusively to Crain’s Data Members. To learn more, visit CrainsCleveland.com/data.